If nothing happens, call your lender, and find out what’s going on. The deed of reconveyance is a legal document, and the lender may take some time to send it out. So, what if your reconveyance deed hasn’t been recorded? Before you start to worry, wait a few weeks after your last mortgage payment. What If A Deed Of Reconveyance Isn’t Recorded Correctly? The deed of reconveyance will then be signed and dated at the closing. In that case, the full payment will be deducted from the sale price and given straight to the lender. However, your new lender will still have a lien on your title until the new loan is paid off.Īnother common scenario is when a homeowner sells their home without having fully paid off the mortgage.

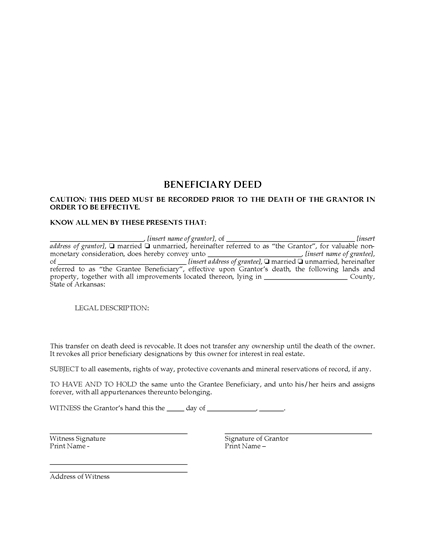

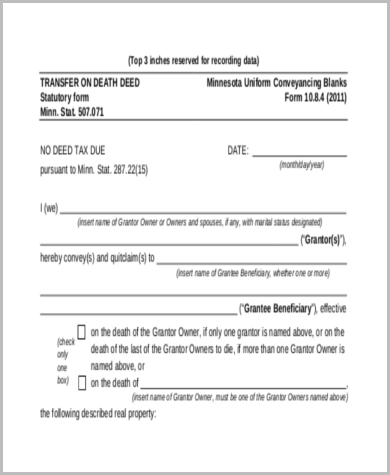

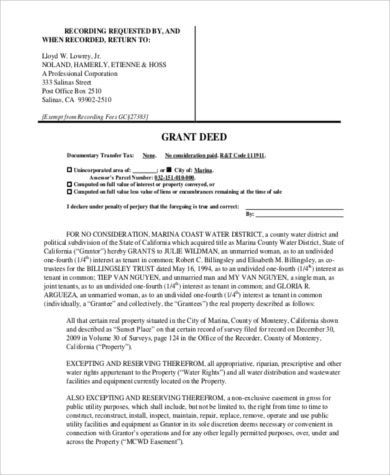

When you do this, you should receive a deed of reconveyance from your original mortgage holder. This most often happens when homeowners refinance their homes at a lower rate. There are some situations where a deed of reconveyance won’t remove all liens on the property. As soon as the county clerk records the deed, the lien will show as paid in any title search. In most states, it will be notarized, but that’s not always the case. The deed will include a description of the property, with the lot number and other relevant details. For example, you still need to pay your property taxes.Ī deed of reconveyance is a legal document that’s recorded at the county clerk’s office, in whatever county the property itself is located in. Keep in mind, though, that a deed of reconveyance doesn’t automatically remove other, non-mortgage obligations. In other words, you own all rights to your property, and the lender can’t foreclose on you. Regardless of what type of document you receive, it means that the lien has been cleared. Another common alternative to a reconveyance deed is what’s called a satisfaction of mortgage. A full reconveyance serves the same purpose as a deed of reconveyance. In those states, you would instead receive something called a full reconveyance. For example, many states use deeds of trust instead of a mortgage. In different states, you will receive different types of documents. This wouldn’t normally happen, but can occur due to lender error. Without one, your lender can still make a claim to your property. Without a deed of reconveyance, it becomes a lot more difficult to sell your home.Įven if you’re not planning to sell your home, you should still get a deed of reconveyance.

This means the title is clear, and the property can be easily sold. A deed of reconveyance, on the other hand, indicates that a lien has been removed. A standard deed is proof of ownership of a property. A deed of reconveyance is different from a normal deed or title.

0 kommentar(er)

0 kommentar(er)